Will The Bridge Close Regen Happen ?

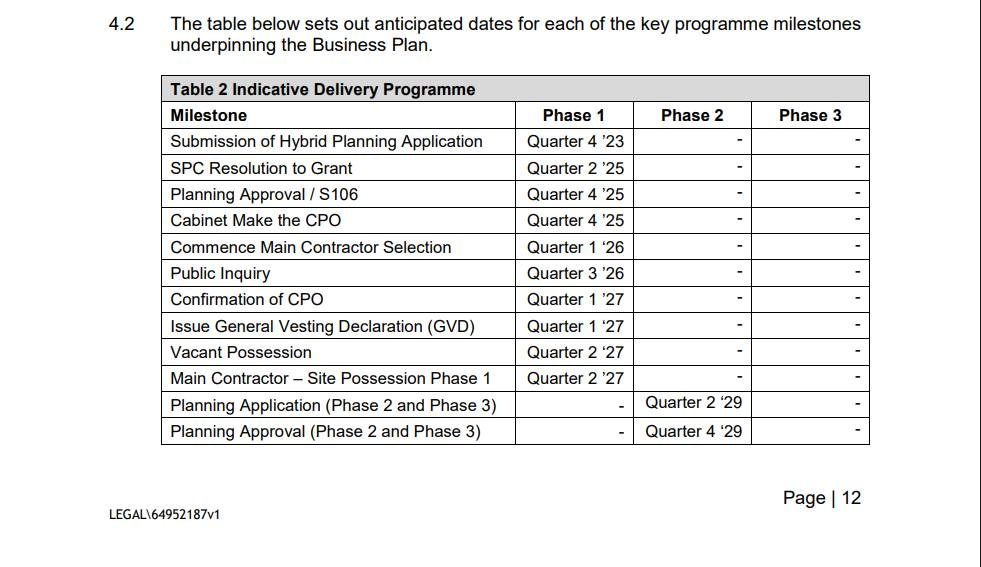

Who would’ve thought that after 8 years of waiting, the Bridge Close regeneration is still no nearer to starting. Here’s the most up to date timeframe from the council

The project would create 1,070 new homes, including 30% affordable housing, a new three-form entry primary school, a community centre, a health centre, a new pedestrian and cycle bridge and extensive investment in the public realm, including the greening and naturalisation of the River Rom. The council still hasn't secured the separate funding for the school and health centre either !

We believe that the regeneration project won’t happen at all, and here’s why:

A Shortfall In Funding

Before they withdrew from the scheme in 2020, a viability assessment conducted by Savills indicated a potential financial shortfall, highlighting the necessity for a £76 million additional subsidy to support the affordable housing component of the project. Without this subsidy, the project could face a deficit of £60 million. In fact the council has split the development into three phases

The entire project is valued at around £451 million, which the council is now responsible for, and given the council’s current financial situation, would require additional borrowing to cover.

In fact the council has split the development into three phases, we imagine they aim to complete the first phase and use sales to fund phase two, and then phase 3.

LBH has recently pumped £270 million into its own development company, Mercury Land Holdings, is there anything now left in the pot ?

Problems With Land Acquisition

LBH still hasn't managed to negotiate the sale of all the associated land, and may face the additional cost and delay of issuing a compulsory purchase order.

The threat of compulsory purchase orders has been hanging over businesses on the industrial estate for years. And some claim the council regeneration scheme is offering them only a fraction of what their properties are worth.

A few of the properties are even back on the market for lease.

Rising Building Costs

Rising building costs are largely driven by escalating material prices, supply chain disruptions exacerbated by the pandemic and geopolitical tensions, and increased labour costs due to a shortage of skilled workers, particularly in the UK.

Industry forecasts predict a continued increase in building costs, with the Building Cost Information Service (BCIS) forecasting a 17% rise over the next five years.

In simple terms it raises the value of the project from £451 million to £528 million

Building Safety Levy And BS999

A new tax is being introduced by the government in 2026, to help cover the remediation costs of dangerously built buildings. The rates vary from £25 per m2 to £100 per m2 based on the building floorspace (including communal areas)

BS9999 is a new industry standard concerning fire safety and evacuation, and mandates evacuation lifts alongside escape stairs in residential buildings, adding costs to high-rise and high-density schemes.

The huge development in Waterloo Rd has been “paused” while the developer now re-evaluates the viability of the scheme, due to the implications of rising costs and BS9999

Borrowing Costs Are Increasing

Rising borrowing costs are a combination of government borrowing needs, inflationary pressures, global economic trends, and central bank actions to control inflation. These factors together make borrowing more expensive for both individuals and businesses.

And it only needs a fairly minor increase in the Bank Of England interest rate, to hit the council in the pocket, and impact the future viability of projects.

Property Prices Are Falling

Signs are starting to emerge that the market is turning. In 2022, prices were rising by 14% a year. That has slowed dramatically, and we are now starting to see absolute falls.

The average price fell by 1.2% in July, a fall of almost £5,000 on the average property, according to figures from Rightmove released in July 2025,

In London, which used to keep driving prices higher, the fall was a more significant 1.5%

So even if the council can find the funding to build the properties, would they be able to sell them ?

The Section 114 Notice Is Looming

Havering council is flat broke. Local authorities cannot actually go “bankrupt” in the way that a company or an individual can. Instead, they issue what is known as a section 114 notice. This is a report from the council’s finance officer that they believe that the authority is about to incur expenditure that is unlawful according to the Local Government Finance Act 1988.1

Once a finance officer issues a section 114 notice, the authority may not incur new spending unless the finance officer permits it to do so. After that, council leadership must meet within 21 days to discuss how to bring their expenditure in line with funding.

Elected members and officers, as well as central government, would then examine options to balance their budget for the year.

If non essential spending is restricted, then the funding for Bridge Close disappears.

The Bottom Line

Given the continued problems with land acquisition and securing additional borrowing, is it safe for LBH to add to their precarious financial position ?

And will a Section 114 notice freeze everything ?

And what does that mean for the Havering Mosque plans ? At the time of writing, the sale of the HICC site on Bridge Close, hasn’t been agreed, and neither has the purchase of 222-226 South St.

Maybe the Havering Mosque may be staying put after all !!